Financial markets have transformed due to artificial intelligence. This article explores how AI and machine learning reshape market analysis, offering faster insights and better results than traditional methods. Whether you’re a financial professional or individual investor, this guide provides actionable insights on leveraging AI for smarter market analysis. The technology amplifies human judgment rather than replacing it, creating new possibilities for everyone in the financial world.

Understanding AI's Impact on Market Analysis

Financial professionals spent hours reviewing reports and market data manually. This approach limited analysis scope. It also introduced human biases into investment decisions. In some respects, market analysis has transformed due to artificial intelligence.

Before exploring further, we should clarify what these technologies really entail. Understanding the difference between AI and Machine Learning helps explain how they process information differently. AI broadly mimics human intelligence across domains. ML, on the other hand, focuses specifically on pattern recognition through data training.

AI market analysis systems offer three critical advantages over traditional methods:

- Speed: Algorithms process information in milliseconds instead of hours

- Scale: Systems can monitor thousands of data sources simultaneously

- Objectivity: Emotional biases decrease with AI-driven analysis

This works practically in various scenarios. When a pharmaceutical company announces trial results at 2 AM, traditional analysts might discover this news hours later. AI systems, meanwhile, instantly flag the development. They analyze potential market impact against historical patterns. They then alert portfolio managers immediately.

The transition to AI-powered analysis amplifies human judgment rather than replacing it. Financial professionals now spend less time gathering information. They focus more on applying strategic thinking to the insights that AI provides. This shift represents a fundamental evolution in how market analysis occurs today.

What Makes AI Different from Machine Learning in Finance?

Financial professionals often use AI and machine learning terms interchangeably, yet understanding their differences actually reveals why some investment strategies perform better. AI represents a broader concept where machines mimic human intelligence across various tasks. Machine learning, in contrast, is sort of a specific subset that focuses on pattern recognition through data training.

Financial markets serve as ideal environments for testing these technologies. AI systems can, in a way, evaluate macroeconomic conditions alongside geopolitical events. They also assess market sentiment simultaneously. This process somewhat resembles how experienced traders naturally synthesize diverse information sources.

Key Technologies Driving Financial Market Analysis

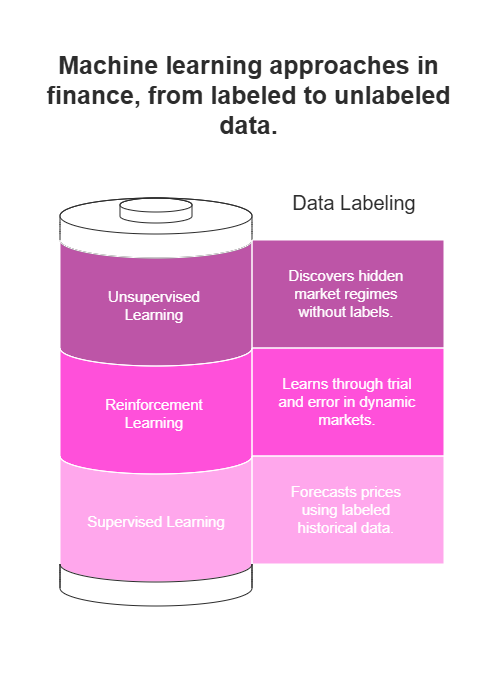

Three primary machine learning approaches pretty much power today’s financial tools. Each type serves different purposes in market prediction. Supervised and reinforcement learning essentially form the foundation of sophisticated trading systems. Unsupervised techniques, meanwhile, provide complementary insights that enhance analysis.

Supervised learning needs labeled historical data to function effectively. Past price movements tagged with “buy” or “sell” signals train these models.

Quantitative funds use this approach to forecast security prices. They analyze technical indicators and fundamental metrics. These models can identify patterns too subtle for human analysts to notice.

Reinforcement learning takes a slightly different path by rewarding algorithms for profitable decisions. It also penalizes losses in a way that mimics human learning.

These systems learn through trial and error in simulated environments. This approach works extremely well in dynamic markets where conditions constantly change.

Unsupervised learning completes the toolkit by discovering hidden market regimes. These algorithms cluster similar trading days without predefined labels.

They can identify anomalous patterns that might signal upcoming volatility. This explains why AI/ML roles in finance will grow 23% by 2030. Financial institutions recognize that combining these approaches creates more robust frameworks than any single method alone.

Essential AI Tools for Monitoring Market Trends

Have you actually considered how AI platforms transform investment research? Many investors now access powerful market analysis without massive budgets. You can even build your own AI tool that fits specific trading strategies. Nearly 64% of businesses report efficiency gains from custom AI solutions. Let’s explore which options might work best for your needs.

A few remarkable platforms stand out in financial news aggregation:

- AlphaSense basically scans financial documents across multiple languages. Its sentiment analysis detects market mood shifts before mainstream coverage. Monthly plans start at $300 for individuals.

- LevelFields monitors over 6,000 companies for price-impacting events. Their algorithms connect specific happenings with market movements. Basic subscriptions begin at $29/month.

- Rize AI lets users ask complex questions about investment strategies. Questions like “What’s the smartest way to invest $10,000 right now?” yield personalized answers. Prices range from $49-199 monthly.

For those without coding skills, no-code platforms have sort of democratized AI development. These systems allow creation of personalized trend trackers through visual interfaces. Most platforms offer free trials before you commit to paid versions.

When selecting tools, consider three factors: data coverage (which sources they track), integration options (how they connect with existing systems), and alert delivery (how you receive insights).

The most effective approach often combines ready-made solutions with targeted custom tools. This hybrid model balances convenience with personalization while keeping costs manageable for investors at any level.

How AI Uncovers Patterns in Stock Movements

Stock prices rarely move randomly. Behind market fluctuations exist discernible patterns that sophisticated algorithms can detect. These patterns often remain invisible to human traders. AI systems, in fact, decode these signals and transform them into valuable trading insights.

Time-series forecasting builds the foundation of AI-powered stock analysis. Traditional statistical methods struggle with non-linear relationships. Modern neural networks, on the other hand, capture complex temporal dependencies in price data effectively. LSTM networks can, in a way, “remember” relevant price movements from weeks ago. They simultaneously ignore irrelevant fluctuations. This selective memory enables more accurate predictions than conventional models.

Clustering algorithms offer another powerful approach for market analysis. These AI pattern detection systems group stocks with similar behavior characteristics. They reveal which sectors might outperform next in the market cycle. During economic transitions, certain sectors typically lead while others lag. AI can identify this phenomenon earlier than traditional analysis methods. For example, unsupervised learning algorithms might detect healthcare stocks decoupling from broader market movements. This separation could signal a potential defensive rotation before obvious economic indicators emerge.

Pattern-based signal generation combines multiple approaches into actionable strategies. Algorithms process various data points to identify high-probability trading opportunities. These systems analyze:

- Price action (support/resistance levels, chart patterns)

- Volume profiles (unusual trading activity)

- Volatility signatures (option pricing anomalies)

- Cross-asset correlations (relationships between stocks, bonds, currencies)

When multiple patterns align, the system generates high-confidence signals. One hedge fund reported 40% improved returns using such multi-factor recognition compared to single-factor approaches.

The most advanced systems now incorporate sentiment analysis from news sources. They also analyze social media content for additional insights. This creates multi-dimensional signal detection capabilities. These systems capture both technical and fundamental factors driving stock movements. Market participants using these tools gain a significant edge in today’s complex trading environment.

Using Sentiment Analysis to Gauge Market Mood

Numbers tell only half the story in financial markets. The emotional undertones in earnings calls actually reveal much more. News articles and social media posts often signal market shifts before price movements occur. Modern Natural Language Processing (NLP) algorithms now quantify these emotional signals with surprising accuracy.

Corporate earnings calls basically provide rich sentiment data. Savvy investors frequently mine this information for competitive advantage. When executives mention phrases like “challenging environment,” their tone reveals insights beyond official guidance.

Financial teams need specialized tools to process this data effectively. 7 Use-Cases of AI in Finance demonstrates how NLP tools parse these transcripts with remarkable efficiency. These systems deliver up to 64% productivity gains for research teams analyzing hundreds of companies each quarter.

The most sophisticated tools segment sentiment by source type. They recognize that analyst opinions carry different weight than retail investor comments. These platforms also track sentiment evolution over time, identifying shifts in market mood.

Implementation requires careful calibration. Financial markets have their own linguistic patterns and nuances. Terms like “beating expectations” carry specific significance in earnings contexts. Generic models often misinterpret industry jargon, which leads to false signals.

Specialized financial models trained on domain-specific data deliver higher accuracy rates. The improvement can be quite significant compared to general-purpose sentiment tools.

For individual investors without enterprise budgets, several platforms now offer affordable options. These tools democratize access to emotional intelligence that was once exclusive to institutional players. The playing field has become more level as technology advances.

Detecting Anomalies and Early Warning Signals

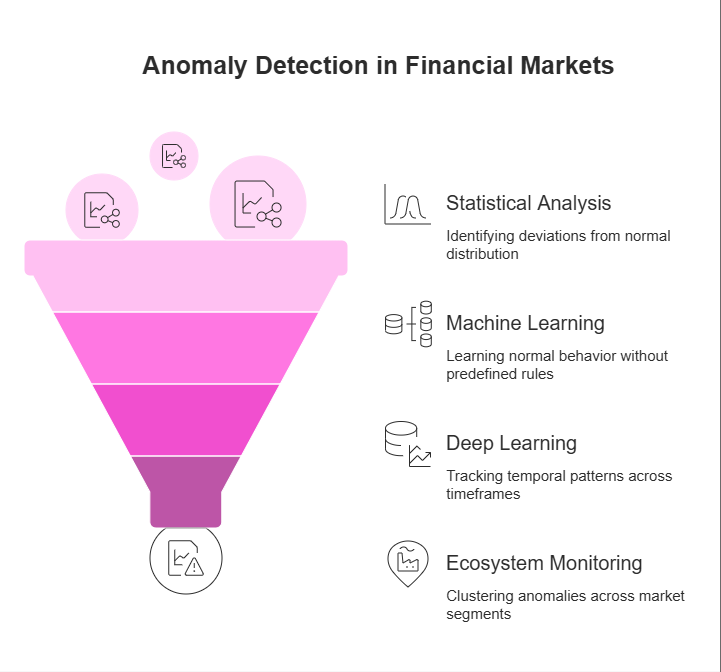

Market crashes rarely appear without warning signs. Actually, subtle indicators often show up before major downturns. These might include unusual trading volumes, correlation breakdowns, or shifts in volatility patterns. Anomaly detection AI effectively spots warnings that traditional risk management typically overlooks.

Financial markets use three main methods for anomaly detection:

- Statistical approaches establish normal distribution patterns for market metrics. When values deviate beyond thresholds (usually 2-3 standard deviations), systems flag potential issues. These methods work well for basic analysis but struggle with complex market conditions.

- Machine learning techniques such as isolation forests and autoencoders learn normal behavior without predefined rules. In a way, autoencoders work by compressing market data then reconstructing it. Large errors during reconstruction indicate possible anomalies. These systems adapt to changing markets better than static statistical models.

- Deep learning models track temporal patterns across multiple timeframes. LSTM networks, for instance, can identify subtle deviations that simpler models might miss completely.

Beyond individual securities, anomaly detection now monitors entire market ecosystems. When multiple anomalies cluster across different segments, sophisticated models can predict liquidity problems with remarkable accuracy. The most effective systems combine several detection methods. This reduces false alarms while maintaining sensitivity to genuine market anomalies.

Crafting an AI-Enhanced Investment Strategy

So, what makes AI tools truly valuable in investing? Well, it’s actually the framework around them. Successful strategies basically require methodical development, rigorous testing, and a bit of human wisdom mixed in.

Systematic Backtesting Approaches

Have you tested your AI signals properly? In a way, many investors rush this crucial step. Clean, comprehensive data spanning multiple market cycles is pretty much essential for this process.

Divide your data, ok? Training sets develop the model, validation sets tune parameters, and testing sets, you know, evaluate final performance. This separation prevents that sneaky “data leakage” problem where future information somehow influences your model.

Beyond raw returns, you might want to examine risk-adjusted metrics too. Sharpe ratios, maximum drawdowns, and win/loss patterns tell a more complete story. Market stress periods often reveal which strategies will literally survive long-term challenges.

Deployment and Monitoring Framework

Ready to launch? A phased approach works best:

- Paper trading without real capital

- Limited allocation with tight risk controls

- Gradual scaling as results validate

After deployment, monitoring becomes absolutely critical. Set up performance drift alerts that basically flag when models behave unexpectedly. Confidence scores tend to decline before model failure, so track them closely.

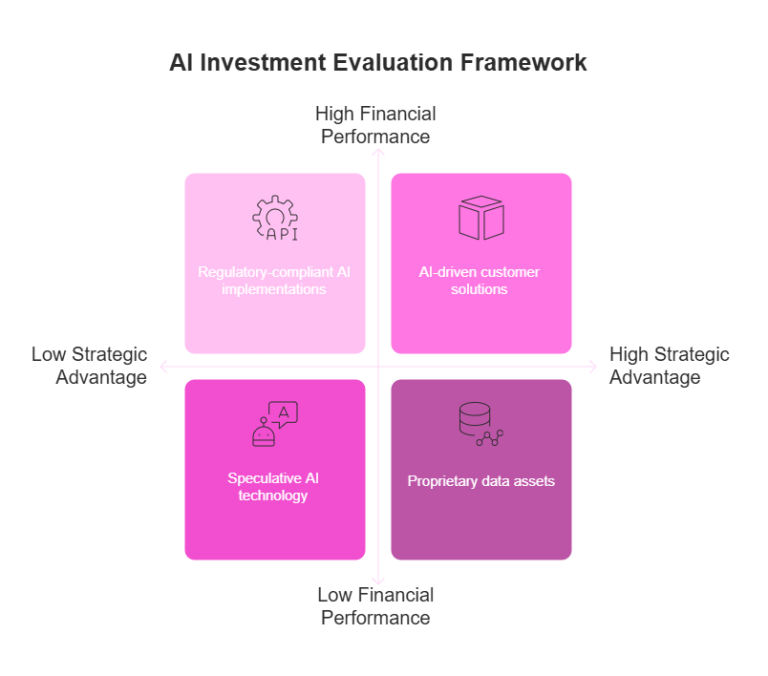

Evaluating AI-Focused Investment Opportunities

Investors should actually consider direct exposure to companies driving this technological revolution, beyond just using AI for market analysis. In a way, the AI ecosystem offers diverse investment paths across hardware, software, and services. Each segment, of course, comes with distinct risk and reward characteristics that savvy investors need to understand.

Understanding the AI Ecosystem

The artificial intelligence landscape basically consists of four segments, each with different investment profiles:

- Infrastructure Layer: Companies providing computing power, data storage, and networking (NVIDIA, AMD, Intel). These firms sort of benefit from the massive computational demands of AI but face intense competition risks.

- Platform Providers: Organizations developing foundational AI models and development tools (Google, Microsoft, Amazon). These companies, in fact, enjoy strong advantages through data moats and ecosystem lock-in.

- Application Developers: Businesses creating industry-specific AI solutions (UiPath, Palantir, C3.ai). This segment offers high growth potential but struggles with lengthy sales cycles.

- AI-Enhanced Services: Traditional companies leveraging AI to transform their offerings (JPMorgan, Goldman Sachs, Pfizer). These established firms might see incremental rather than revolutionary gains.

Cost Considerations Beyond Headlines

Implementation expenses frequently exceed projections, despite AI’s transformative potential. Research actually indicates that hidden costs of AI adoption surprise 53% of organizations in various ways.

When evaluating AI investments, you should scrutinize:

- R&D intensity ratios (R&D spending as percentage of revenue)

- Customer acquisition costs versus lifetime value

- Data acquisition and cleaning expenses (often 60-80% of project budgets)

Ongoing model maintenance requirements can sometimes double initial implementation costs. This reality often catches new investors off guard.

Key Metrics for Sustainable Growth

Looking beyond traditional financial metrics becomes necessary for effective evaluation. You might want to focus on:

- Data Moats: Assess proprietary data assets that competitors cannot easily replicate

- Talent Density: Measure AI expertise concentration (PhDs per 100 employees)

- Deployment Efficiency: Track time-to-value for new AI implementations

Regulatory positioning matters too, as companies with robust compliance frameworks for emerging AI regulations tend to face fewer disruptions.

The most promising investments demonstrate clear paths to monetization rather than speculative technology development. Companies that translate AI capabilities into measurable customer outcomes consistently outperform pure technology plays.

For retail investors, ETFs focusing on specific AI segments offer diversified exposure. This approach eliminates the need for deep technical expertise when evaluating individual companies.

Navigating Challenges and Ethical Considerations

AI tools present significant challenges despite their analytical power. Pros and Cons of Using AI Tools explores how these systems increase speed while reducing errors. Yet they also create transparency issues and potential biases that need careful management.

The Black Box Problem

Sophisticated AI models often function as “black boxes” in a way that puzzles users. These systems produce outputs without explaining their reasoning. Financial markets particularly struggle with this opacity. Explainability serves as a regulatory requirement in many jurisdictions. Investors naturally want to understand why an algorithm might recommend selling a historically strong position.

Data Quality and Bias Concerns

AI systems mirror the data they consume. Historical biases often exist in financial datasets.

Algorithms may amplify these biases rather than correct them. This creates serious challenges for fair analysis.

Common issues in financial AI include:

- Survivorship bias (analyzing only companies that survived past market downturns)

- Recency bias (overweighting recent market conditions)

- Geographic bias (overrepresenting developed markets with better data availability)

Addressing these concerns requires rigorous preparation protocols. Leading firms now employ dedicated data quality teams for this purpose.

These specialists clean and normalize datasets before system integration. They also test data thoroughly for potential biases.

Many organizations maintain diverse training data spanning multiple market cycles. This approach helps reduce geographic and temporal limitations.

Governance Framework Essentials

Effective AI governance in finance requires three core components. Each element plays a crucial role in responsible implementation.

First, human oversight remains essential. Establish clear review processes where qualified professionals evaluate outputs. This step prevents algorithmic errors from causing financial harm.

Second, documentation standards matter tremendously. Maintain comprehensive records of development processes and data sources. Validation procedures should be clearly documented as well.

Third, regular audits help identify problems early. Schedule independent reviews to catch drift, bias, or performance issues. These checks protect both performance and reputation.

Many financial institutions adopt a “three lines of defense” approach. Business units serve as first-line users of the technology. Risk management teams act as second-line reviewers. Internal audit functions provide third-line validation.

Successful organizations view AI ethics as valuable risk management. This perspective protects investment performance while building stakeholder trust. With transparent governance, firms can harness AI’s power responsibly.

How accurate are AI-driven stock movement predictions?

AI models can achieve stock prediction accuracy of up to 95%. However, market volatility means no model is entirely accurate. AI models often perform better than human analysts. Accuracy depends on both the data and algorithm utilized.

What are the key metrics for evaluating AI companies?

Key metrics include user satisfaction, model accuracy, and return on investment. User retention rate is also important. These metrics help measure business impact, technical performance, and user engagement.

How can I balance AI insights with human judgment?

AI improves decision-making, but human judgment is still essential for nuanced choices. It is important to balance AI with human insight in investing. Human intuition and critical thinking enhance AI’s efficiency.

What ethical risks should investors watch when using AI?

Investors should watch for data integrity issues and transparency challenges. Regulatory uncertainties are also important. These risks could undermine investor trust and fairness in the market.