AI startups captured 44% of invested capital in 2025, shifting funding dynamics and competitive pressure. This brief delivers 20 validated AI in startups statistics that show exactly where adoption moves metrics—cycle time, ARR velocity, headcount leverage—so you can decide this quarter whether to hire, buy, or prioritize product investment. We cover adoption rates, efficiency gains, revenue outcomes, product development speed, and competitive risk.

This brief is for founders, CEOs, and investors who need startup benchmarks to inform near term resource decisions. Each statistic includes source context, sample methodology, and one-line implications for hiring, tooling, or GTM allocation. Findings are organized into five outcome sections: Adoption & Maturity; Efficiency & Resource Leverage; Revenue & Scaling; Product & GTM Impact; Competitive Dynamics & Investment Signals. Use this as your decision checklist to map AI statistics 2026 trends to runway planning and operational priorities.

AI Adoption and Maturity Across Startup Stages

Adoption rates tell half the story. Maturity progression reveals what founders can actually act on. Understanding where your startup sits between experimentation and embedded AI determines whether you’ll capture operational leverage or burn runway on pilots that never ship.

USD 49.2 Billion Flowed to Generative AI Startups in H1 2025

Global venture funding in generative AI reached USD 49.2 billion in H1 2025, surpassing the entire 2024 total. If you’re raising capital, show investors how AI delivers measurable operational leverage—faster onboarding cycles, fewer manual handoffs, compressed sales sequences—not just feature differentiation.

88% of Enterprises Now Use AI in At Least One Function

Enterprise AI adoption jumped to 88% in 2025, up from 78% a year earlier. Position your product to integrate seamlessly with enterprise AI workflows—buyers expect AI-native tooling, not legacy interfaces retrofitted with chatbots.

AI-Native Startups Hit $30M ARR in 20 Months vs. 60+ for Traditional SaaS

Investor roundtable data from 2023 showed AI companies reaching $30M ARR within 20 months compared to over 60 months for traditional SaaS peers. AI-native startups compress time-to-revenue by automating customer acquisition, onboarding, and support—reducing manual GTM friction before competitors establish market position.

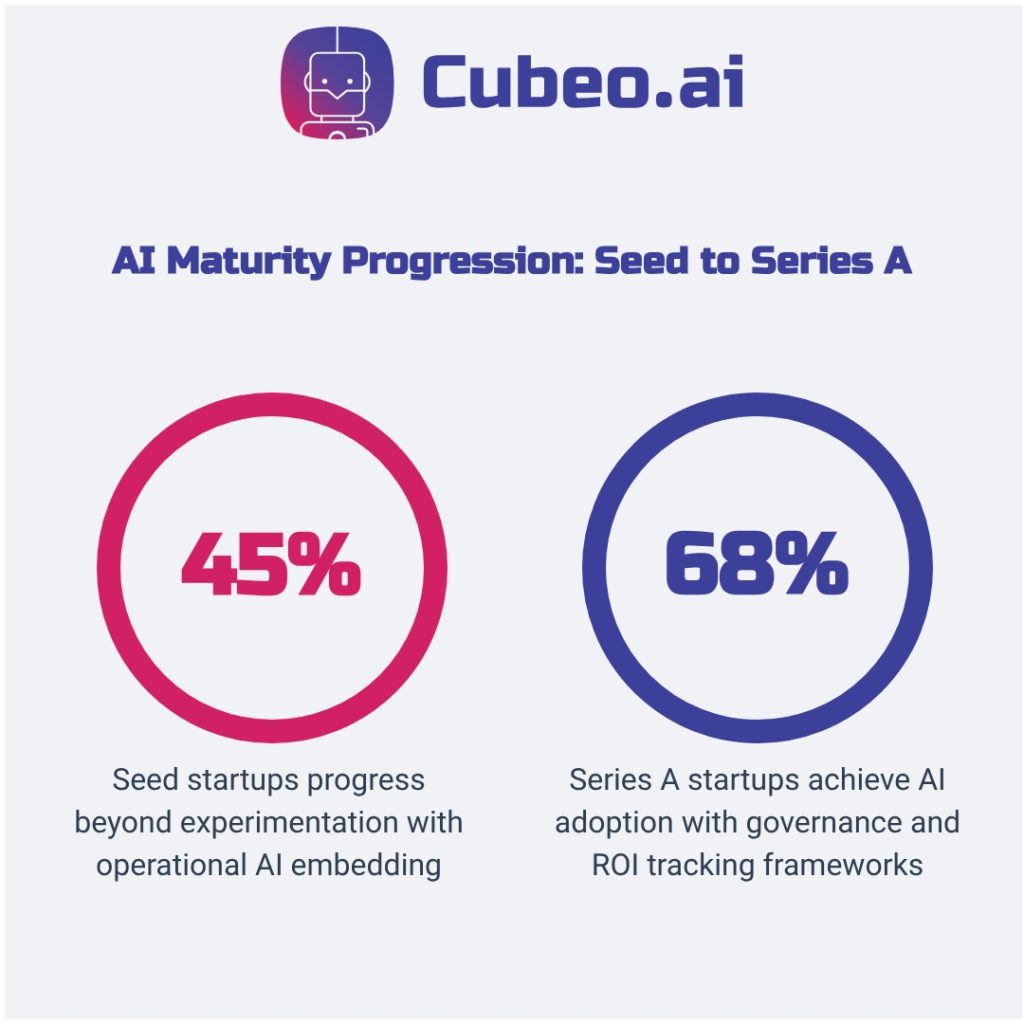

Only 45% of Seed Startups Progress Beyond Experimentation

Adoption rates climb from 45% at Seed to 68% at Series A, yet most early teams fail to embed AI operationally due to missing governance, monitoring, and ROI tracking.

Resource Efficiency and Operational Leverage

Maturity buys real leverage when you reassign freed hours to work that moves ARR, retention, or product velocity. Which workflows you automate first determines whether time savings compound into competitive advantage or evaporate into busywork.

Company-Reported AI Saves Average Worker 2.5 Hours Per Day

HubSpot reports workers save approximately 2.5 hours daily by delegating repetitive tasks to AI—data entry, content formatting, routine communication. If you automate content operations across 10 people, expect roughly 0.5 to 1 FTE to shift from production to strategy. Budget hiring and define the strategic outcomes you want that capacity to deliver.

Benchmarks Indicate Lower FTE Requirements for AI Companies

Automated workflows that replace repeated handoffs cut staffing needs in onboarding, support, and billing. Invest in workflow guardrails, model monitoring, and human-review checkpoints to make this leverage reliable rather than just theoretically possible.

Ambient AI Scribes Save Physicians 15+ Hours Weekly

Physicians using ambient AI scribes save roughly 15+ hours per week on clinical documentation. Vertical AI tools that automate domain-specific workflows deliver outsized efficiency gains. If you’re building vertical AI, quantify time savings in domain units—hours per patient, contracts per day—to accelerate enterprise sales cycles.

Support Workload Reductions Around 15% Free Capacity for Retention Work

AI-powered triage, response drafting, and knowledge-base search reduce agent workload by approximately 15%. Redeploy that capacity into proactive customer success rather than headcount reduction—retention gains usually outweigh pure cost cutting when you’re establishing product-market fit.

Revenue Growth and Scalability Outcomes

Efficiency gains mean little if they don’t translate into revenue acceleration. The best proof of AI’s operational value appears in ARR velocity—how fast startups reach key revenue milestones and what GTM levers they pull to sustain that growth.

AI Supernova Startups Reach $125M ARR by Year Two

Top-performing AI startups reach approximately $40M ARR in year one and $125M ARR by year two, with ARR per FTE averaging $1.13M—roughly 4-5x above typical SaaS benchmarks. If you have daily-engagement workflows, prioritize growth engineering and community operations hires to capture expansion revenue faster than episodic-use competitors.

Fast ARR Doubling Times Signal Strong Product-Market Fit

AI products with viral distribution loops and embedded workflows achieve exponential growth unmatched by traditional SaaS.

Enterprise AI Security Firms Scale Rapidly to Premium Valuations

Abnormal Security scaled to over $200M ARR in five years with 100%+ year-over-year growth (company disclosure). The company closed a $5.1B valuation in November 2025. If you’re targeting enterprise, quantify risk reduction and compliance acceleration—those urgencies shorten sales cycles and support premium pricing when the pain point is mission critical.

Pipeline Conversion Uplifts Around 30% from AI Personalization

Portfolio benchmarks show AI-driven personalization of demos and proposals increases conversion rates by approximately 30% through better buyer context matching. Invest in AI-personalized outreach early—conversion gains compound faster than top-of-funnel volume increases alone.

Product Development and Go-to-Market Impact

AI-native companies move to market 3.6x faster than AI-enabled peers. Product speed becomes your lever when you automate high-friction workflows and keep humans on judgment calls—ship features quickly with built-in guardrails and you turn development velocity into pipeline.

AI Cuts Contract Review Time 50-80% in Case Studies

OECD and vendor case studies document 50-80% reductions in contract review cycles through automated clause extraction, risk flagging, and compliance checks. Deploy validation layers and human-in-the-loop checks when risk is high—speed gains collapse if accuracy drops.

Sales Reps Save 40-60 Minutes Daily on Average

Workers save 40-60 minutes daily by automating CRM data entry, meeting summaries, and follow-up drafting; specialized sales automation deployments report higher time savings in vendor studies. Redirect freed time to discovery and relationship-building—conversion rates improve when reps spend more time with customers than on administrative logging.

Marketing Teams Save 40-60 Minutes Daily on Content Tasks

Saved time also comes from AI-powered content generation and editing (survey of 300 software executives). Use this time to test more messaging variations—velocity in experimentation drives better product-market fit faster than perfecting one campaign.

Feature Delivery Time Drops from 8 to 3 Weeks

Average feature cycles fell from 8 to 3 weeks through AI-assisted prototyping and automated testing. ICONIQ case studies corroborate up to 50% cycle reductions. Adopt the AI-Enabled Product Sprint—Understand, Prototype, Validate, Launch—to cut your next feature cycle by half while maintaining cross-functional guardrails.

Competitive Dynamics and Future Outlook

Only 3 of 7 leading AI firms conduct substantive dangerous-capability testing, revealing governance gaps that create competitive risk for laggards. Stanford’s AI Index shows 78% organizational adoption in 2024— buyer and investor expectations have moved AI from optional to table stakes.

U.S. Private AI Investment Hit $109.1 Billion in 2024

U.S. private AI investment reached $109.1 billion in 2024, nearly 12 times China’s $9.3 billion. Significant capital flows to foundation models and infrastructure providers signal investor conviction in platform economics. If you’re building on these platforms, focus on vertical-specific workflows—differentiation lies in domain expertise rather than model capability.

64% of Business Owners Believe AI Increases Productivity

Forbes Advisor reports 64% of business owners believe AI will improve productivity. Widespread conviction drives adoption momentum across sectors. Position AI capabilities as operational leverage rather than feature differentiation—buyers expect AI-native tooling as baseline functionality now.

AI Adopters Grow 1.8x Faster; Laggards Lose ~30% Share in Two Years

Startups embedding AI in core workflows achieve faster revenue growth, higher retention, and better unit economics than laggards.

AI Engineering Salaries Command 5-20% Premiums

AI engineers earn 5-20% more in base salary compared to traditional software engineers (5% in smaller markets, up to 20% in competitive hubs for specialized ML skills), with equity premiums adding 10-20%. Risk mitigation playbook: upskill existing teams, invest in guardrails and monitoring, align leadership KPIs to AI outcomes.

FAQ

How does AI accelerate startup growth compared to traditional SaaS models?

AI-native startups are achieving significantly faster growth, higher valuations, and more efficient customer acquisition compared to traditional SaaS models. This acceleration is rooted in AI’s capacity to deliver superior, decision-owning outcomes and seamlessly integrate into existing systems, fundamentally reshaping market dynamics and investment strategies.

Our data shows AI-native companies reaching 360% year-over-year growth in new customer acquisition, a stark contrast to the 24% seen in traditional SaaS. This translates to acquiring new customers at 15x the rate, driven by a lower-friction sales process where AI products, built for clear outcomes, often “sell themselves.” These companies also demonstrate 1.6x better sales efficiency, maximizing revenue per marketing dollar. The key lies in AI products’ greater embeddability into existing tech stacks, leading to faster adoption and nearly double the conversion rates compared to traditional software.

This rapid growth enables AI-native companies to allocate more resources to R&D, continuously innovating their product while traditional SaaS firms often find themselves redirecting spend to sales and marketing to maintain growth. For builders, this underscores the importance of developing AI systems that not only deliver measurable business metrics but are designed for seamless integration and continuous improvement, unlocking new operational efficiencies and market opportunities.

What is the competitive risk of not adopting AI in 2026?

By 2026, the competitive risk of failing to adopt AI strategically is a quiet but relentless erosion of market position, as businesses without embedded AI will face escalating operational costs, reduced efficiency, and an inability to match the agility of AI-powered rivals.

AI is no longer an innovation for the future; it’s a critical driver of operating costs, team efficiency, and rapid decision-making. Companies treating AI as a mere experiment risk being perpetually on the defensive. Those unable to leverage AI to reduce unit operational costs will subtly lose competitiveness quarter after quarter. The true differentiator by 2026 won’t be AI investment, but enterprise-scale AI adoption, how deeply AI is integrated into decision-making and human workflows. A lack of strategic adoption will relegate AI initiatives to “perpetual pilots,” impressive in concept but lacking tangible impact.

For operators, this means moving beyond experimentation to build a defensible AI baseline, complete with robust governance. We need clear documentation of AI use cases, continuous monitoring for model drift, integrated human oversight, and defined accountability.

How much should startups invest in AI tools and talent?

Startups should strategically invest in AI tools and talent, recognizing this as a critical battleground for competitive advantage that often necessitates significant capital for acquiring top-tier expertise and developing bespoke solutions that deliver measurable business outcomes.

The current landscape is marked by intense AI talent wars, with top AI professionals commanding high-figure offers and strategic acquihires

reflecting the market’s high valuation of specialized AI human capital. Venture capital continues to pour into AI startups, particularly those focused on AI-powered recruitment and biotech, indicating strong investor confidence in this sector. Many successful startups aren’t just buying off-the-shelf; they’re leveraging AI to build custom tools for specific needs, like enhanced CRM or business analytics, which provides greater flexibility and control compared to generic third-party solutions.

While the precise investment will vary, the core principle remains: align AI investment with overall business objectives. This includes a clear roadmap for implementation, dedicated infrastructure, and, critically, securing the right talent. For us, it’s about more than just funding; it’s about architecting a system that supports reliable, production-ready AI automation. This approach ensures the investment translates into tangible business metrics without demanding that every team member becomes a prompt engineering specialist, empowering them to focus on outcomes.