AI statistics in finance show the transformation is already here: 88% of financial institutions run AI systems in production today (IIF-EY Survey, 2024).

Financial services AI spending is projected to reach $97 billion by 2027 (RGP Research, 2024). When 98% of finance leaders plan to increase AI infrastructure spending by the end of 2025 (SME Finance Forum, 2024), the competitive landscape is being redrawn.

The following 30 sourced benchmarks are organized by adoption trends, operational impacts, and governance requirements. Each statistic includes its source and a direct implication you can act on immediately, whether that’s piloting an FP&A automation Agent or implementing real-time risk monitoring Triggers with clear controls.

Adoption and Investment Trends in Finance

Investment data reveals where finance leaders are placing their AI bets. These benchmarks help you justify budgets and set realistic deployment timelines.

Global AI Spending Reaches $35 Billion

Private AI investment in financial services hit $35 billion (Stanford HAI, 2025). Implication: Use this funding momentum to request pilot budget for transaction-monitoring Agents.

78% Have Production AI Deployments

Production AI deployments span 78% of financial organizations (Stanford HAI, 2025). Earlier surveys reported 88% using broader definitions. Implication: Pilot FP&A automation Agents to join the majority.

15-20% Average First-Year ROI

Early AI implementations deliver 15-20% first-year returns (Stanford HAI, 2025). Implication: Start with compliance monitoring Triggers to achieve measurable ROI within 12 months.

65% Prioritize Fraud Detection Investment

Fraud detection leads investment priorities for 65% of institutions (Stanford HAI, 2025). Implication: Build your first Agent around transaction anomaly detection for proven funding approval.

North America Leads with 45% Market Share

North America captures 45% of financial AI market share (Stanford HAI, 2025). Implication: Leverage no-code platforms to accelerate implementation regardless of regional technical resources.

Average Implementation Timeline 8-12 Months

Traditional AI projects require 8-12 months from concept to production (Stanford HAI, 2025). Implication: Deploy no-code Agents in weeks to gain competitive advantage over traditional approaches.

60% Increase AI Budgets Year-over-Year

AI budgets grew 60% year-over-year across financial services (Stanford HAI, 2025). Implication: Propose scalable Agent architectures that expand with increased funding allocations.

Large Banks Invest $50M+ Annually

Major institutions allocate $50M+ annually to AI initiatives (FSB, 2025). Implication: Right-size proposals to institutional scale using enterprise-grade no-code platforms.

Cloud-First Approach in 85% of Projects

Cloud infrastructure powers 85% of financial AI deployments (FSB, 2025). Implication: Design Agents for cloud-native deployment with on-premises integration for regulatory compliance.

Pilot-to-Production Success Rate 42%

Only 42% of AI pilots successfully scale to production (Stanford HAI, 2025). Implication: Choose proven no-code platforms to avoid the 58% failure rate through simplified deployment.

These patterns show clear implementation opportunities. Review 10 specific use cases where institutions are seeing success to prioritize your next AI initiative.

Operational Impact Across Finance Functions

Performance data shows what you can achieve with AI automation. Pick one no-code Agent to pilot this quarter and measure specific improvements within 90 days.

50% Improvement in Fraud Detection Accuracy

AI fraud detection systems deliver 50% accuracy improvements (RTS Labs, June 11, 2025) while processing transactions in milliseconds. Implication: Pilot a real-time monitoring Agent to reduce false positives by 30% in 90 days; track alerts per 10k transactions.

1M+ Transactions Processed Per Second

Modern AI systems handle over 1 million transactions per second (RTS Labs, June 11, 2025) for real-time analysis. Implication: Scale transaction monitoring Triggers to handle peak volumes; measure processing latency under load.

80% Reduction in Customer Service Response Time

AI chatbots achieve 80% faster response times (Brookings Institution, April 2025) by handling routine inquiries instantly. Implication: Automate customer service with 7 proven AI applications to cut response time 60% in 60 days.

Robo-Advisors Manage $100+ Billion AUM

Automated investment platforms manage over $100 billion in assets (RTS Labs, June 11, 2025) with minimal oversight. Implication: Build portfolio rebalancing Agents to execute trades automatically; measure cost per transaction reduction.

25% Faster Loan Approval Processing

AI underwriting accelerates loan decisions by 25% through alternative data analysis (Brookings Institution, April 2025). Implication: Deploy credit scoring Agents to cut approval time from 5 days to 3; track application-to-decision hours.

90% Accuracy in Document Processing

Automated document processing reaches 90% accuracy (Brookings Institution, April 2025) for contract analysis and data extraction. Implication: Run document-processing Triggers to cut manual review hours by 40% in 30 days; validate on 200-contract samples.

35% Cost Reduction in Back-Office Operations

Back-office automation delivers 35% cost savings (RTS Labs, June 11, 2025) through intelligent task routing. Implication: Automate reconciliation processes to save 20 hours weekly; measure transaction matching accuracy improvements.

95% Customer Query Resolution by Chatbots

Advanced chatbots resolve 95% of routine inquiries (RTS Labs, June 11, 2025) without human intervention. Implication: Validate conversational Agents handling account inquiries; target 90% resolution rate with 24/7 availability.

60% Improvement in Risk Assessment Speed

AI risk models process assessments 60% faster (Brookings Institution, April 2025) while maintaining accuracy. Implication: Implement risk scoring Triggers for real-time credit evaluation; measure decision speed improvements.

40% Increase in Cross-Selling Success

Personalization engines boost cross-selling by 40% (RTS Labs, June 11, 2025) through behavioral analysis. Implication: Create recommendation Agents using 8 fintech applications to increase product adoption 25% quarterly.

These operational gains create compelling business cases, but successful scaling requires governance frameworks and risk controls to ensure compliance and stability.

Risk Management and Governance for AI in Finance

You need governance frameworks that satisfy regulators while enabling rapid deployment. These benchmarks show which controls to implement first.

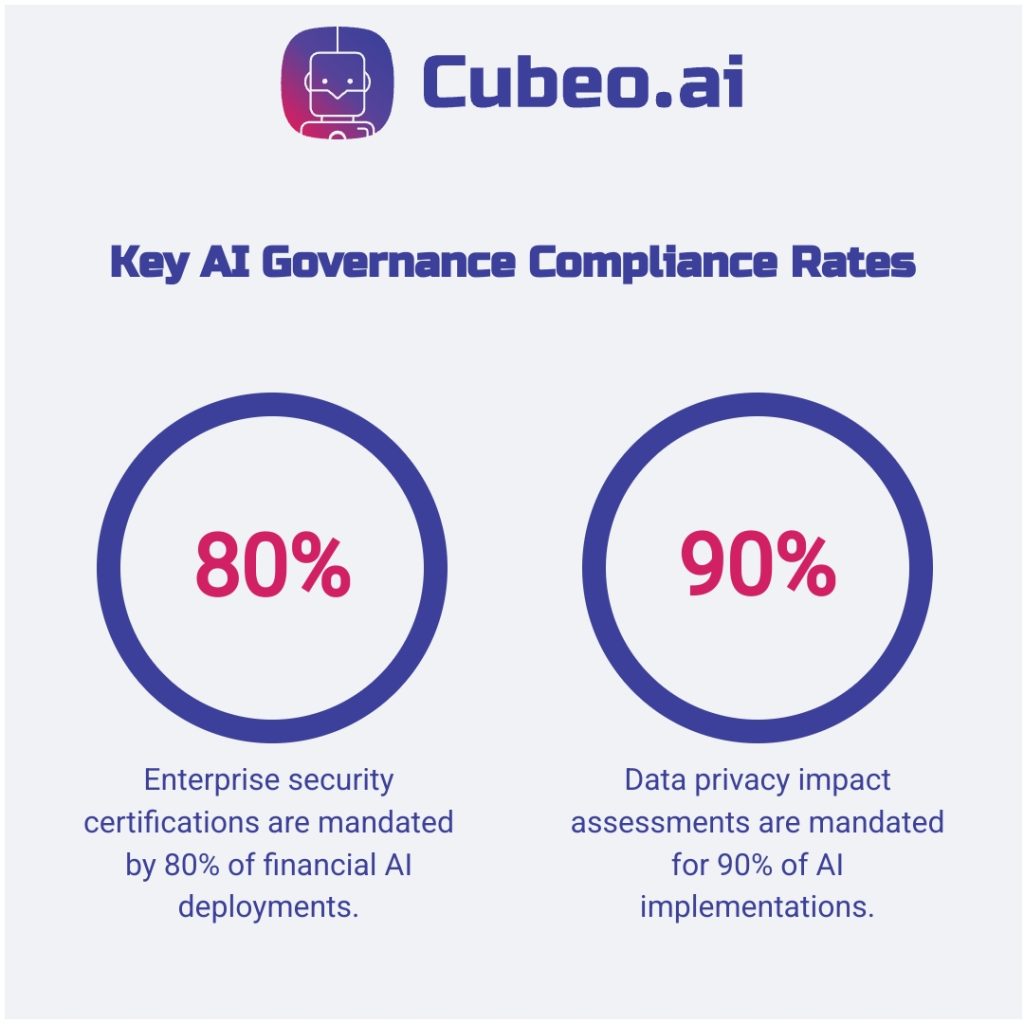

80% Require Enterprise Security Certifications

Financial institutions demand enterprise security certifications for 80% of AI deployments (Consumer Finance Monitor, August 18, 2025). Deploy Compliance Verification Agent to validate ISO certifications → target approval within 30 days.

$2M Average Annual Compliance Investment

Compliance costs average $2M annually, with Massachusetts AG requiring $2.5M penalties (Consumer Finance Monitor, August 18, 2025). Run Budget Planning Agent to allocate 15% governance spend → track cost per audit.

72% See AI as Augmenting Roles

Workforce transformation shows 72% of institutions view AI as augmenting roles (RGP Research, July 2025). Launch Skills Assessment Agent to identify training gaps → certify 80% staff in 90 days.

55% Implement Model Risk Management Frameworks

Model governance adoption reaches 55% across institutions (RGP Research, July 2025). Deploy Model Validation Agent for bias testing → trigger reviews when drift exceeds 5% monthly.

90% Mandate Data Privacy Impact Assessments

Data privacy requirements mandate impact assessments for 90% of implementations (Consumer Finance Monitor, August 18, 2025). Execute Privacy Audit Agent → complete assessments within 14 days of deployment.

45% Report Regulatory Uncertainty as Top Barrier

Regulatory uncertainty blocks 45% of AI initiatives (RGP Research, July 2025). Implement Compliance Monitoring Agent → flag regulatory changes affecting your use cases within 24 hours.

30% Increase in Risk Management Headcount

Risk management teams expand by 30% for AI oversight (RGP Research, July 2025). Deploy Hiring Pipeline Agent → identify qualified AI governance candidates and reduce time-to-hire 40%.

85% Conduct Regular Algorithm Audits

Algorithm auditing becomes standard for 85% of firms (RGP Research, July 2025). Schedule Audit Execution Agent → run quarterly performance reviews and generate compliance reports automatically.

60% Face Skills Gap in AI Governance

Skills gaps affect 60% of institutions (Consumer Finance Monitor, August 18, 2025). Launch Training Coordination Agent → match staff to certification programs and track completion rates.

75% Require Board-Level AI Oversight

Board oversight becomes mandatory for 75% of banks (Consumer Finance Monitor, August 18, 2025). Create Executive Reporting Agent → generate monthly AI risk dashboards for board review.

These governance controls provide the foundation for scaling AI initiatives while maintaining regulatory compliance and operational stability.

Conclusion

These 30 statistics show adoption is mainstream, operational gains are measurable, and governance is non-negotiable. 80% of CFOs lead AI strategy with 63% seeing payment automation improvements (Citizens Bank, September 2024).