This article explores how AI transforms expense management and financial reporting from manual headaches into strategic assets. Finance teams waste hours on outdated processes that introduce errors and fraud risks. Modern AI solutions offer a better way forward.

The Current Challenges of Manual Expense and Financial Reporting

Finance departments struggle with outdated expense management systems. These systems drain resources and introduce unnecessary risks. In fact, recent studies show employees spend over an hour monthly on expense reports alone. Nearly 75% report taking more than 15 minutes to file each report, which basically multiplies across organizations into significant productivity losses.

Data entry errors plague traditional systems at alarming rates. A staggering 75% of businesses acknowledge that manual expense tracking increases fraud risk, according to FinTech Insights. In some respects, the situation is worse than many realize.

These errors result in reporting inaccuracies that affect strategic decisions. The disconnect between real-time spending and month-end reporting creates additional complications. Finance teams operate with outdated information, making it difficult to spot trends promptly.

This workflow opacity presents significant audit challenges. While AI solutions offer tremendous efficiency benefits—completing tasks in seconds rather than hours—they sometimes introduce their own “black box” problems. AI tools require substantial high-quality data to function effectively, which can be a barrier for smaller finance teams.

Manual financial reporting faces several measurable challenges that impact businesses:

• Manual reconciliation typically delays financial insights by 2-3 weeks

• Companies lose approximately 5% of annual revenue to expense fraud and policy violations

• Nearly half of employees report reimbursement delays due to outdated approval workflows

These financial reporting challenges create a compelling case for automation. Yet, the transition from manual expense management requires careful planning to avoid trading familiar problems for new complications.

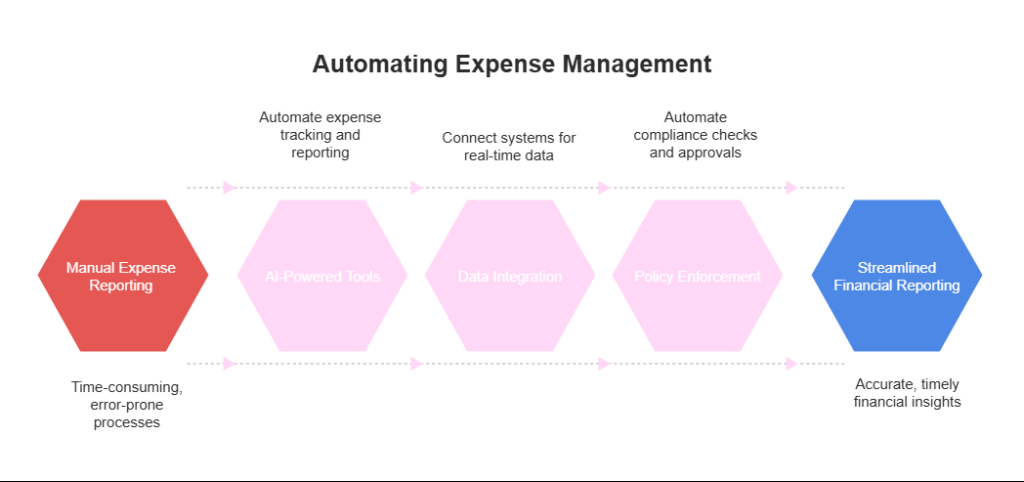

How AI Changes Expense Management Workflows

Expense management has undergone a remarkable transformation thanks to artificial intelligence. Gone are the days of manual receipt processing and tedious data entry. AI solutions now actually handle these tasks with unprecedented speed and accuracy, freeing finance teams to focus on strategic work.

Beyond data capture, machine learning algorithms analyze spending patterns across organizations. These systems identify unusual transactions that might indicate policy violations.

Adding another layer of intelligence, natural language processing automatically categorizes expenses without human input. NLP engines, in a way, understand context and distinguish between similar vendors. For example, a coffee purchase at an airport might be labeled “travel expense” rather than “meals” based on timing and location data.

As a result, finance teams experience several key benefits:

• Nearly 80% reduction in data entry time

• More accurate expense categorization

• Real-time visibility into spending patterns

• Automated policy compliance checks

The combination of these AI technologies creates a seamless expense management ecosystem that provides financial insights previously impossible with manual systems.

Key Technologies Powering Automated Expense Workflows

Modern expense automation relies on three powerful technologies that actually transform how finance teams process transactions. Each technology brings unique capabilities to streamline operations and boost accuracy.

Advanced OCR engines now reach accuracy rates between 98-99% for standard business documents. This represents a significant improvement over earlier systems that struggled with different fonts and formats.

Machine learning algorithms serve as detection systems for unusual spending patterns. These programs establish baseline behaviors for employees and departments, then flag any deviations that might indicate problems. Current benchmarks show detection accuracy reaching 0.86 AUC, with processing speeds under 11 milliseconds per transaction.

Finance teams receive alerts about potential policy violations before approving reimbursements. This proactive approach, you know, prevents fraud rather than just catching it after money has been paid out. The system works by comparing each expense against historical patterns and policy rules.

Retrieval-augmented generation combines large language models with real-time data retrieval to enhance expense reporting. RAG systems ensure reports reflect current policies and exchange rates by pulling information from multiple sources as needed. When sales representatives submit international expenses, RAG pipelines automatically apply appropriate currency conversions based on location.

The combination of these technologies creates a pretty powerful ecosystem that transforms expense management:

• OCR captures receipt data with near-perfect accuracy

• Machine learning identifies suspicious patterns and policy violations

• RAG enriches transactions with contextual data from multiple sources

How AI Automates Financial Reporting in Real Time

Month-end closing processes have become somewhat outdated. Finance teams across industries now use AI solutions for their reporting needs. These tools transform static financial documents into dynamic dashboards. Users gain instant visibility into company performance metrics.

Seamless connections enable this transformation between expense platforms and enterprise systems.

Continuous close cycles offer another significant advancement. Finance teams no longer wait until month-end to reconcile accounts. Instead, AI systems perform ongoing validation throughout the month. Recent benchmarks show organizations using this approach cut closing timelines by up to 70%. Financial reporting transforms from backward analysis to a forward-looking strategic asset.

Modern dashboards provide impressive drill-down capabilities. Finance leaders start with high-level metrics and KPIs. They can then click through to more detailed information layers. This functionality extends all the way to individual receipts and invoices. Teams quickly spot spending anomalies and trends that might stay hidden in combined data sets.

AI-driven financial reporting delivers several key benefits:

• Almost complete elimination of manual data entry

• Reduction in reporting errors by up to 90%

• Financial decisions based on current rather than historical data

• Better compliance through automated audit trails

Tangible Benefits of AI in Expense and Financial Reporting

Numbers tell the story when measuring AI’s impact on financial operations. Organizations using AI-powered expense tools report measurable advantages that boost bottom-line results. In fact, these benefits become apparent almost immediately after implementation.

Time and cost savings emerge as the primary advantage. Financial workers save roughly 57 minutes daily with AI tools, according to recent studies. This efficiency basically translates to major cost reductions. Gartner suggests companies with AI-augmented automation will cut operational costs by nearly 30% this year. Fraud prevention capabilities deliver equally impressive outcomes. The Association of Certified Fraud Examiners reports that fraud costs businesses about 5% of annual revenue. That equals approximately $5 trillion globally. AI transforms spend management by automatically flagging suspicious transactions before processing. Predictive models identify unusual patterns, with some systems cutting false positive alerts by 60%. This proactive approach explains why 77% of finance leaders plan increased AI investment in 2025.

Employee satisfaction scores rise significantly with these implementations. Mobile interfaces allow staff to capture receipts instantly, eliminating the dreaded month-end report crunch. Automated workflows speed up reimbursement timelines, with many organizations reporting:

• 50% reduction in processing time

• 70% decrease in lost receipts

• 90% improvement in policy compliance

• 85% increase in satisfaction with expense processes

Real-World Examples of AI Success in Finance

Numbers tell stories of change in finance departments worldwide. Let’s explore three companies that achieved impressive results through successful implementation of AI tools.

A global manufacturing firm struggled with receipt matching accuracy around 60%. They implemented an AI solution with advanced OCR. Within three months, their match rate jumped to 94%. Staff saved countless hours previously spent on manual reconciliation.

The system actually learned continuously. It adapted to company-specific vendors and expense types over time. This improvement mirrors what we’ve witnessed at several tech startups. These companies reduced monthly reporting time by nearly 40% through similar automation.

Budget visibility changed operations at a mid-sized healthcare provider. Their old system offered only monthly spending snapshots. This often revealed budget problems too late. Their new AI dashboard delivered spending insights immediately.

The results were quite remarkable. Managers spotted concerning trends right away. This led to a 22% reduction in unnecessary spending within one quarter. Real-time alerts about approaching thresholds prevented numerous potential overruns.

Fraud prevention success came dramatically for a financial services firm. They used anomaly detection to flag unusual patterns. Small-value transactions appeared legitimate individually. Together, they revealed a sophisticated fraud scheme.

Mastercard uses similar technology in their Decision Intelligence system. It evaluates over 1,000 data points per transaction. This approach improved fraud detection by 20% while reducing false positives.

These stories share common elements: thoughtful implementation and proper training. The companies didn’t just add technology—they changed processes. In a way, they created new workflows that empowered teams to work differently.

Best Practices for Implementing AI Expense and Reporting Solutions

Successful AI implementation goes beyond just picking the right technology. It actually requires a strategic approach addressing organizational readiness, stakeholder concerns, and process integration.

Start by examining your current expense management pain points. In a way, this assessment creates the foundation for your entire project.

User adoption metrics should guide your implementation timeline. Pretty much every successful rollout we’ve seen follows this principle. One financial services firm achieved 85% adoption within three months. They created a network of “AI ambassadors” providing peer support during transition. These champions celebrated early wins and addressed concerns promptly.

AI implementation is a journey, not a destination. To be honest, the most successful organizations plan for continuous improvement cycles. These cycles incorporate user feedback and adapt to evolving business needs. Regular check-ins with stakeholders help identify new opportunities for optimization.

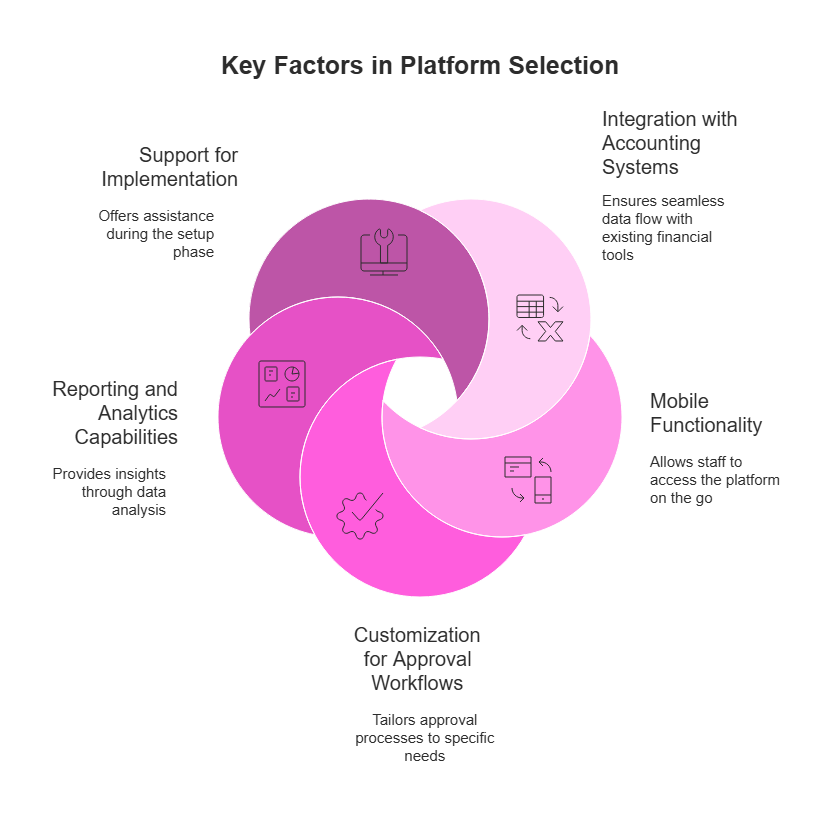

Top AI-Powered Tools for Expense Management and Reporting

Choosing an AI expense management solution actually requires balancing features, pricing, and organizational needs. We’ve analyzed several platforms to help you find the right fit for your business situation.

In our experience, the market offers options across various price points. Each solution provides different advantages depending on your company size and expense complexity.

For small to mid-sized businesses, we find Expensify quite impressive with its OCR technology. It achieves nearly 95% accuracy when extracting receipt data. Pricing begins at $5 per active user monthly, while enterprise levels reach $9. The mobile app works offline, so your team can scan receipts without internet connection. Policy controls include customizable workflows and spending limits.

Growing companies might prefer Ramp’s approach to financial management. In a way, their business model differs from others – the base service has no monthly fees. Instead, they make money through card transaction revenue. Their AI matches receipts automatically, which basically eliminates manual reconciliation tasks. Companies with complex approval structures benefit most from this platform.

Zoho Expense offers a more economical solution starting at just $3 per user monthly. Their AI assistant, Zia, handles expense categorization pretty well. While it processes standard receipts effectively, sometimes complex formats need manual fixes. International businesses appreciate its multi-currency support.

For larger organizations, we’ve seen SAP Concur provide the most comprehensive features. Their pricing typically ranges from $8-12 per user monthly. The system’s machine learning algorithms improve categorization based on your company’s patterns.

When selecting a platform, consider these factors:

• Integration with existing accounting systems

• Mobile functionality for traveling staff

• Customization for approval workflows

• Reporting and analytics capabilities

• Support for implementation

The right solution combines powerful automation with user-friendly interfaces that your team will actually use.

Measuring ROI and Planning for Long-Term Success

AI ROI analysis starts with a structured approach. Companies need to capture immediate gains alongside future value creation. Before implementation, finance teams should set clear metrics to measure impact effectively.

Cost reductions form the basis of hard ROI calculations. Track automation-related labor savings, eliminated storage expenses, and reduced error correction time.

Soft benefits deliver significant long-term value despite quantification challenges. These include better decision-making through real-time data access and enhanced compliance.

Key performance indicators should monitor multiple aspects:

• Operational metrics: Average processing time per expense report (target: 75% reduction)

• Quality metrics: Error rates and exceptions (target: 90% reduction)

• Financial metrics: Cost per expense report processed (target: 50% reduction)

• Strategic metrics: Time spent on analysis vs. data processing (target: 3:1 ratio)

Establish baseline measurements before implementation, ok? Collect data for at least two reporting cycles to account for seasonal variations.

Continuous improvement needs systematic feedback loops. Create quarterly reviews that examine performance against targets. Forrester’s research shows 49% of organizations expect AI investment returns within one to three years, making regular assessment vital.

Successful implementations sort of evolve through phased enhancements. Organizations should start with core functionality, measure results, then expand based on demonstrated value. This approach builds confidence while delivering incremental benefits that compound over time.

Future Trends Shaping AI in Financial Operations

Financial operations face remarkable transformation possibilities. The next wave of AI advances will elevate expense management from reactive processes to strategic business drivers.

Predictive analytics in finance represents a game-changing evolution. Machine learning algorithms analyze historical spending patterns. They also factor in external economic indicators.

Generative AI creates fascinating fraud detection opportunities. These models can actually imagine what fraud might look like—even schemes never seen before. This approach builds synthetic fraud scenarios to train systems proactively. According to Business Insider, Mastercard’s AI now processes 160 billion transactions yearly. It generates risk scores in milliseconds while reducing false positives.

Financial planning integration breaks traditional silos between expense systems and strategic finance. Expense data feeds forecasting models automatically. This creates a continuous planning cycle instead of static budgets. CFOs can run scenarios showing how policy changes might affect cash flow. They can sort of predict impacts months before implementation.

These advancements will reshape finance roles:

• Analysts shift from data gathering to insight generation

• Auditors focus on system governance rather than transaction sampling

• Budget managers become strategic advisors instead of spending police

Finance teams will evolve from record-keepers to strategic partners. Companies embracing these tools early gain advantages through smarter resource allocation and risk management.

FAQ

How do OCR and machine learning improve reporting accuracy?

OCR and machine learning enhance reporting accuracy through automation. These technologies automate data extraction from receipts and invoices. They also categorize expenses with greater precision. As a result, human error decreases, and real-time updates become possible.

Which factors should finance leaders consider when selecting an AI solution?

When selecting an AI solution, finance leaders should consider several factors. Features and integration capabilities with existing systems are important. Security and scalability to accommodate business growth also matter. A user-friendly interface and robust support are essential for successful implementation.

How can organizations measure ROI after implementing AI in expense workflows?

Organizations can measure ROI by tracking specific improvements. Cost savings achieved through automation should be monitored. Time reductions in expense processing are another key metric. Improved efficiency and accuracy in expense reporting also contribute to ROI measurement.

What emerging AI trends will shape financial operations next?

Several emerging AI trends are poised to shape financial operations. Advanced fraud detection systems will become more prevalent. Predictive analytics for forecasting and risk management will also expand. AI-driven customer service enhancements and the use of quantum computing are additional trends to watch.